Tired of waiting weeks to open a business bank account? Frustrated with rigid banking processes that don’t keep up with your business? We get it.

Founded in 2015 by entrepreneurs who know firsthand the demands of rapid growth, OakNorth was built to empower high-growth companies to push boundaries and achieve more. We’ve already supported thousands of businesses, lending over £12bn since inception to fuel business expansion, job creation, and much-needed housing.

Now, we’re empowering high-growth businesses to scale at speed with our business current accounts, savings options, cards, payment solutions, and more.

Business current account

Business savings

Easy access

95-day notice

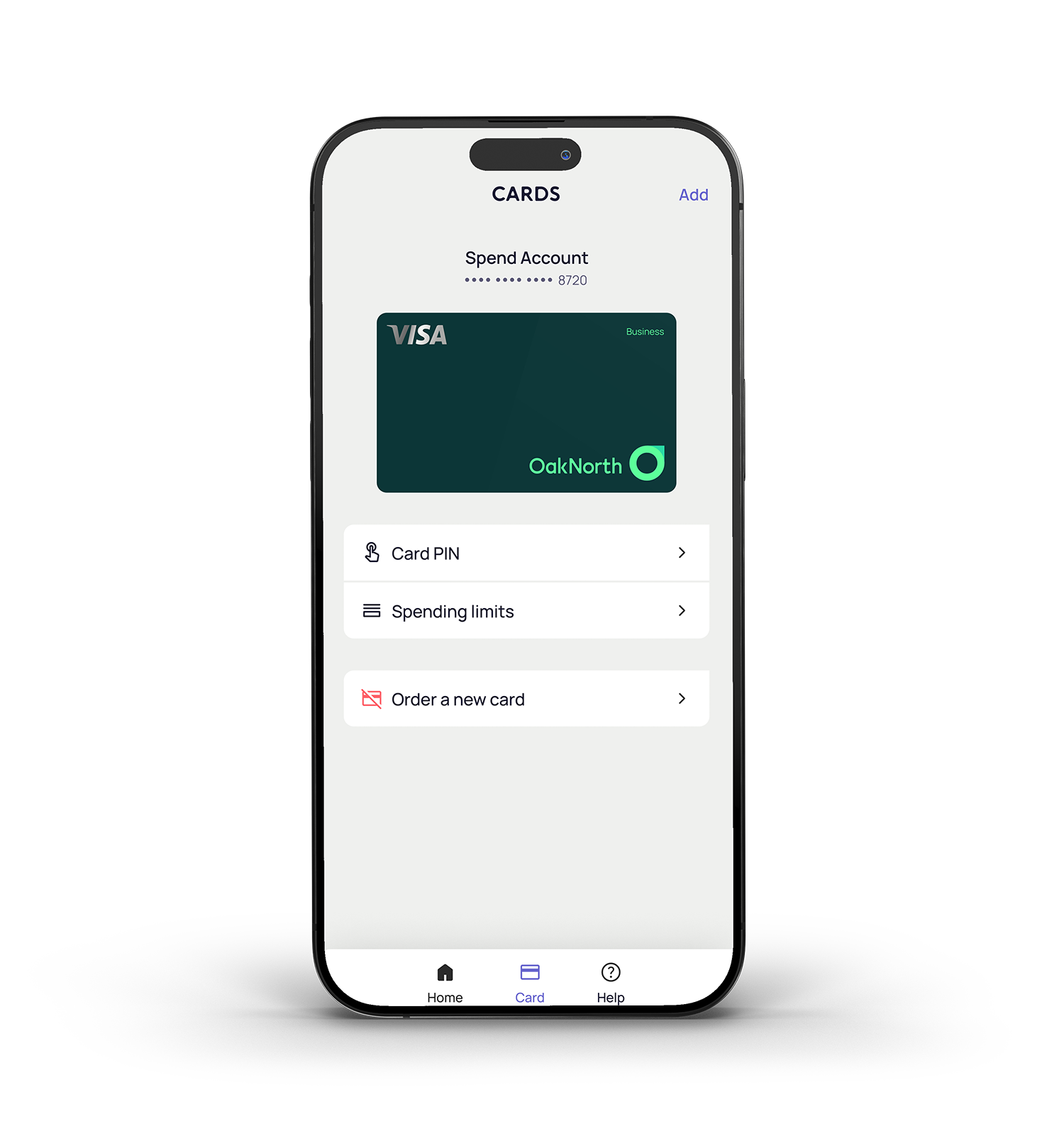

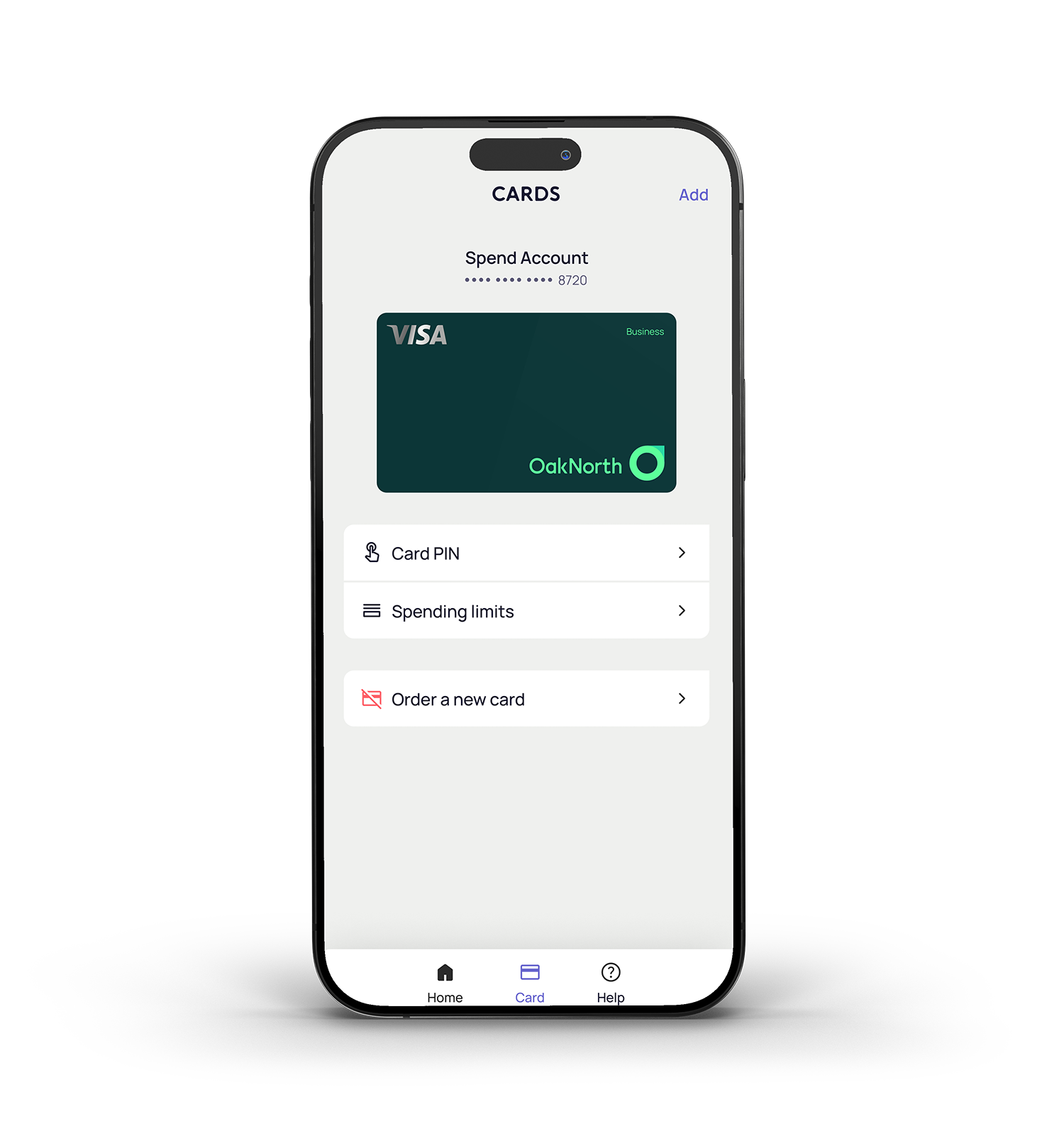

Visa business debit card

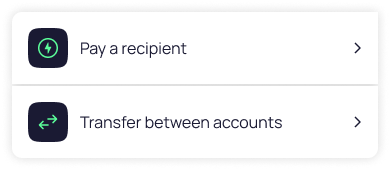

Managing your money and business

UK-regulated and here for the long haul.

We operate in the top tier of commercial banks.

All eligible deposits are protected up to £85,000.

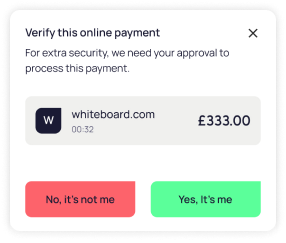

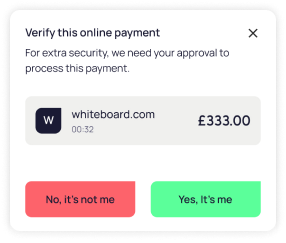

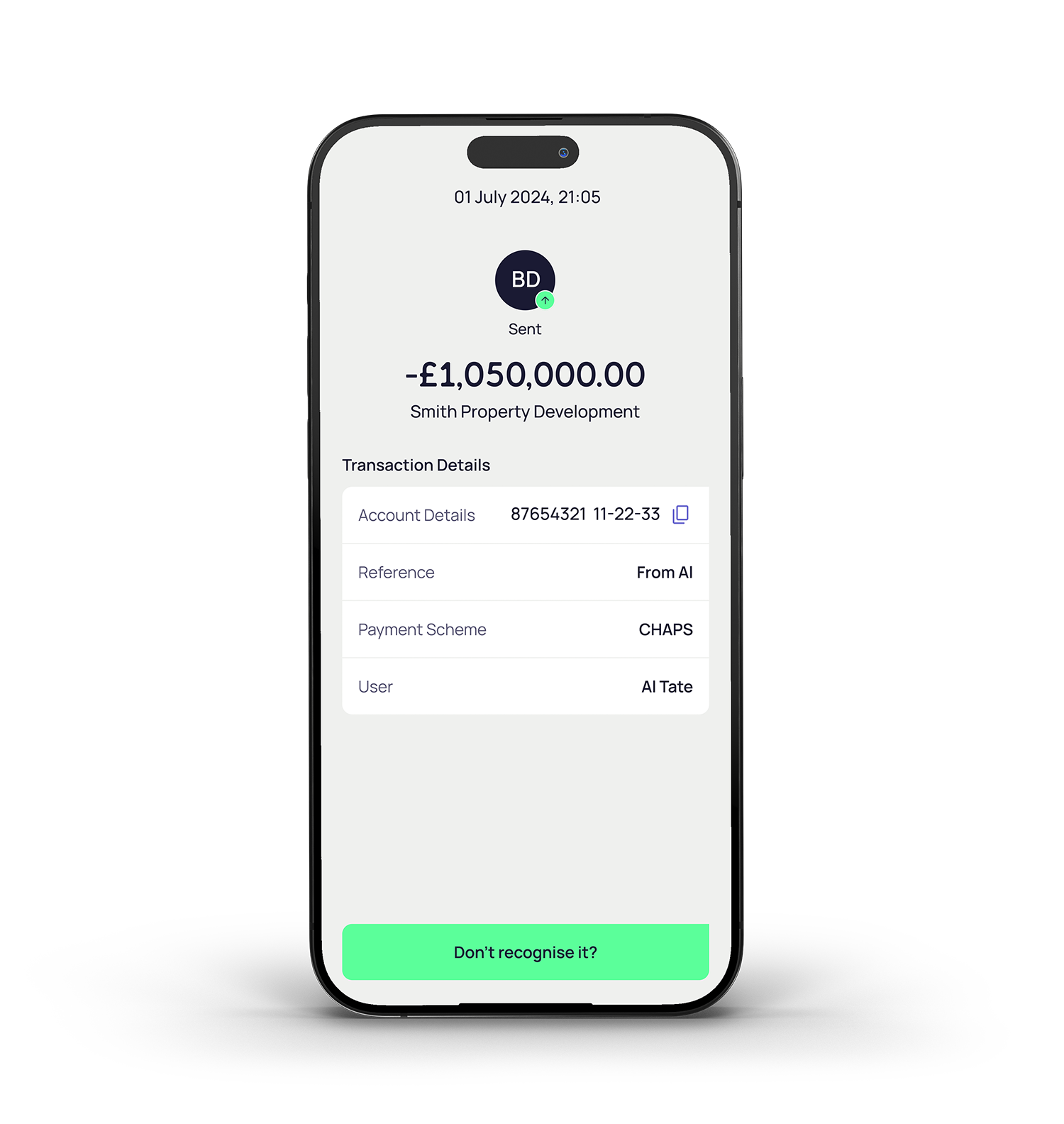

Superior fraud detection systems and strong encryption.

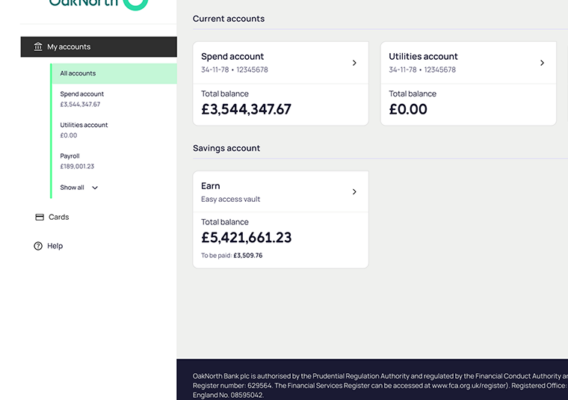

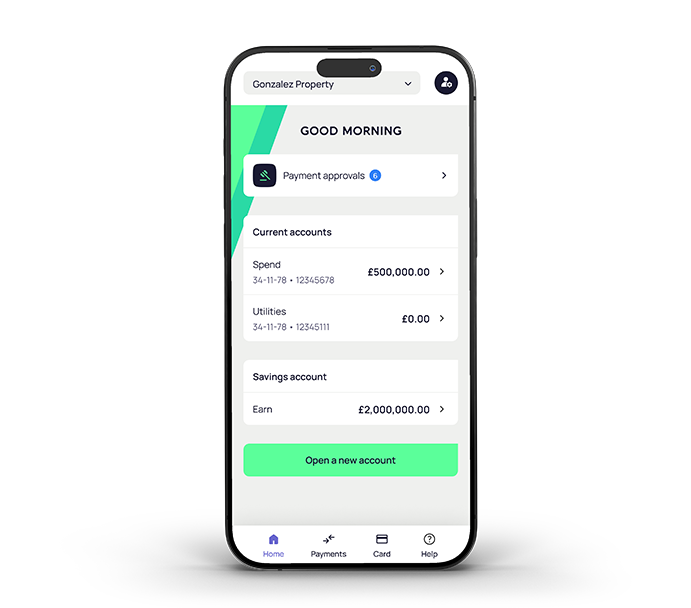

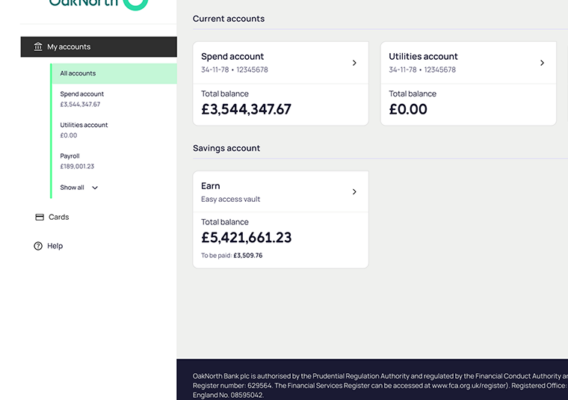

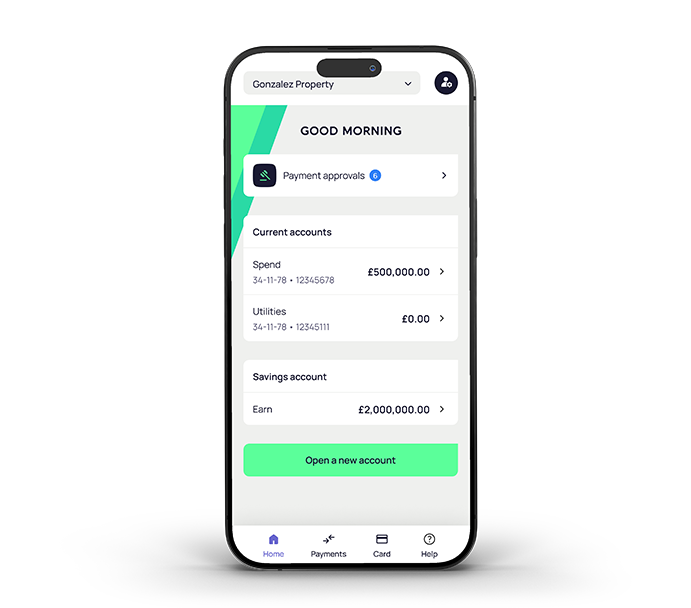

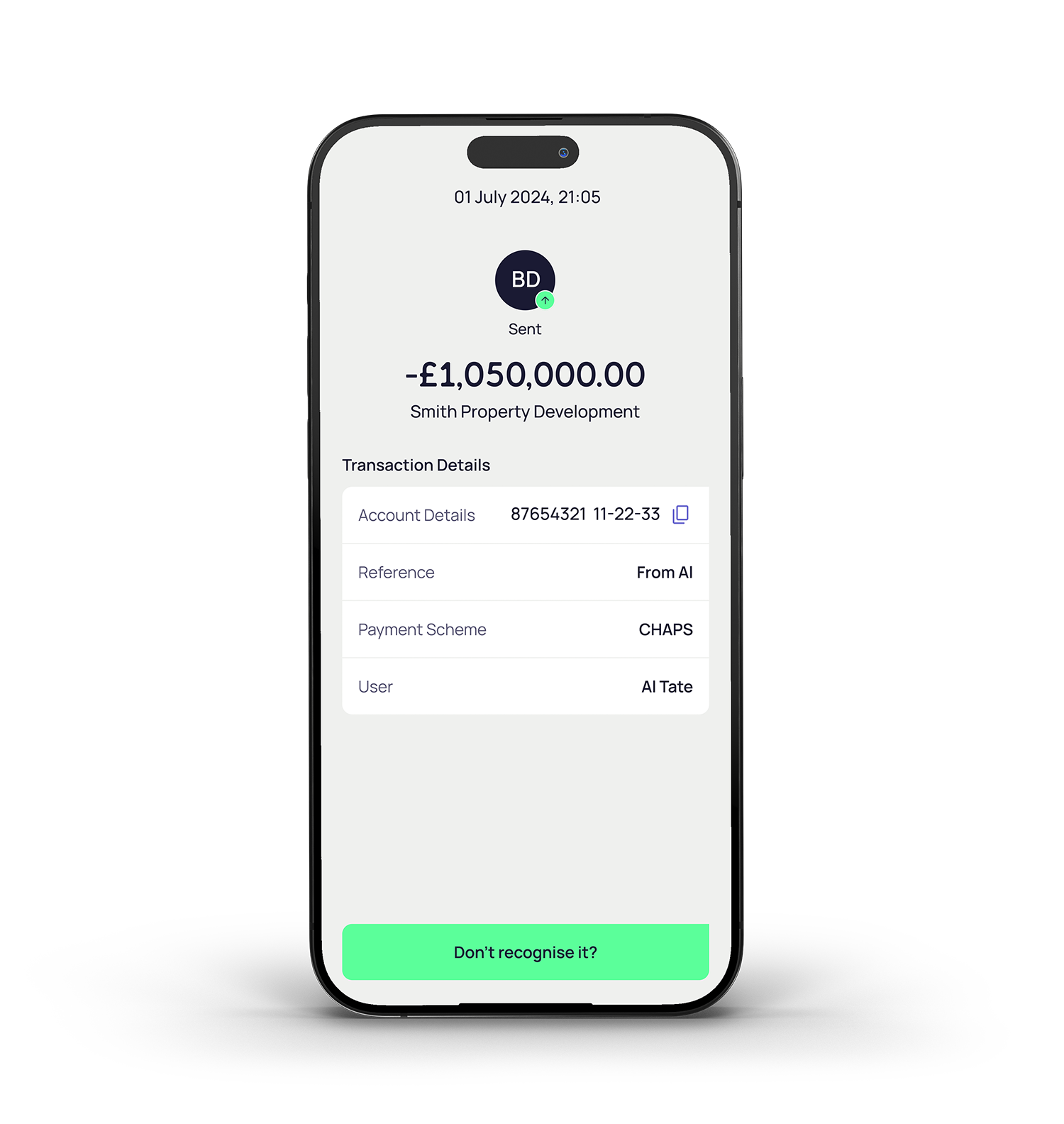

Managing multiple entities shouldn’t mean juggling multiple logins and systems. Our multi-company accounts feature brings everything under one roof, making it easy to switch, track, and control finances across all your businesses (at no cost!). With our multi-company accounts, you get:

From simplifying multi-company management to unlocking bespoke finance, we turn complexity into clarity—giving you the freedom to focus on your next big move.

Whether you need to add a new user to your account or discuss a potential business opportunity, you’ll have a dedicated Business Partner backed by a team that knows your business inside out. Gone are the days of waiting on hold.

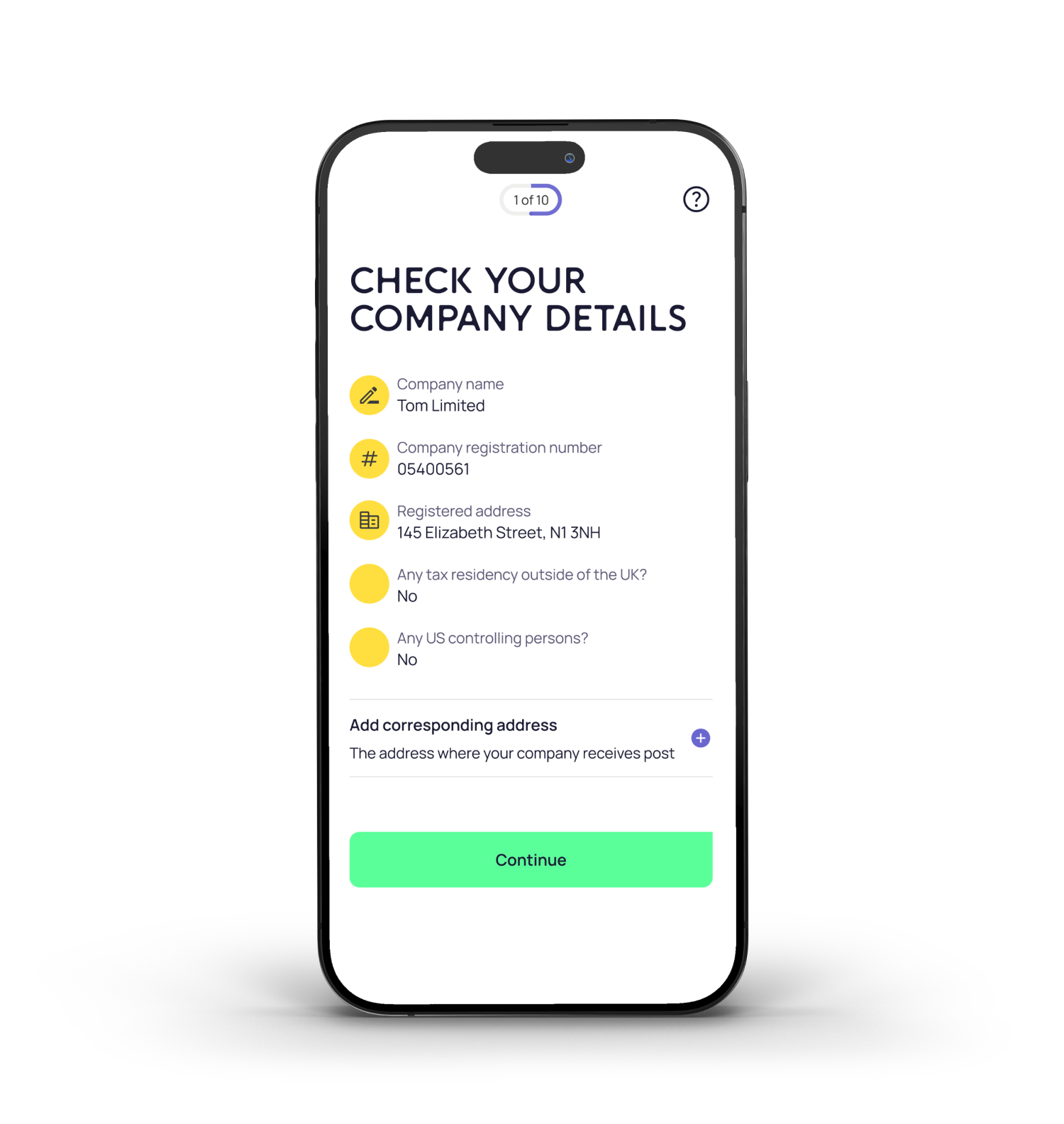

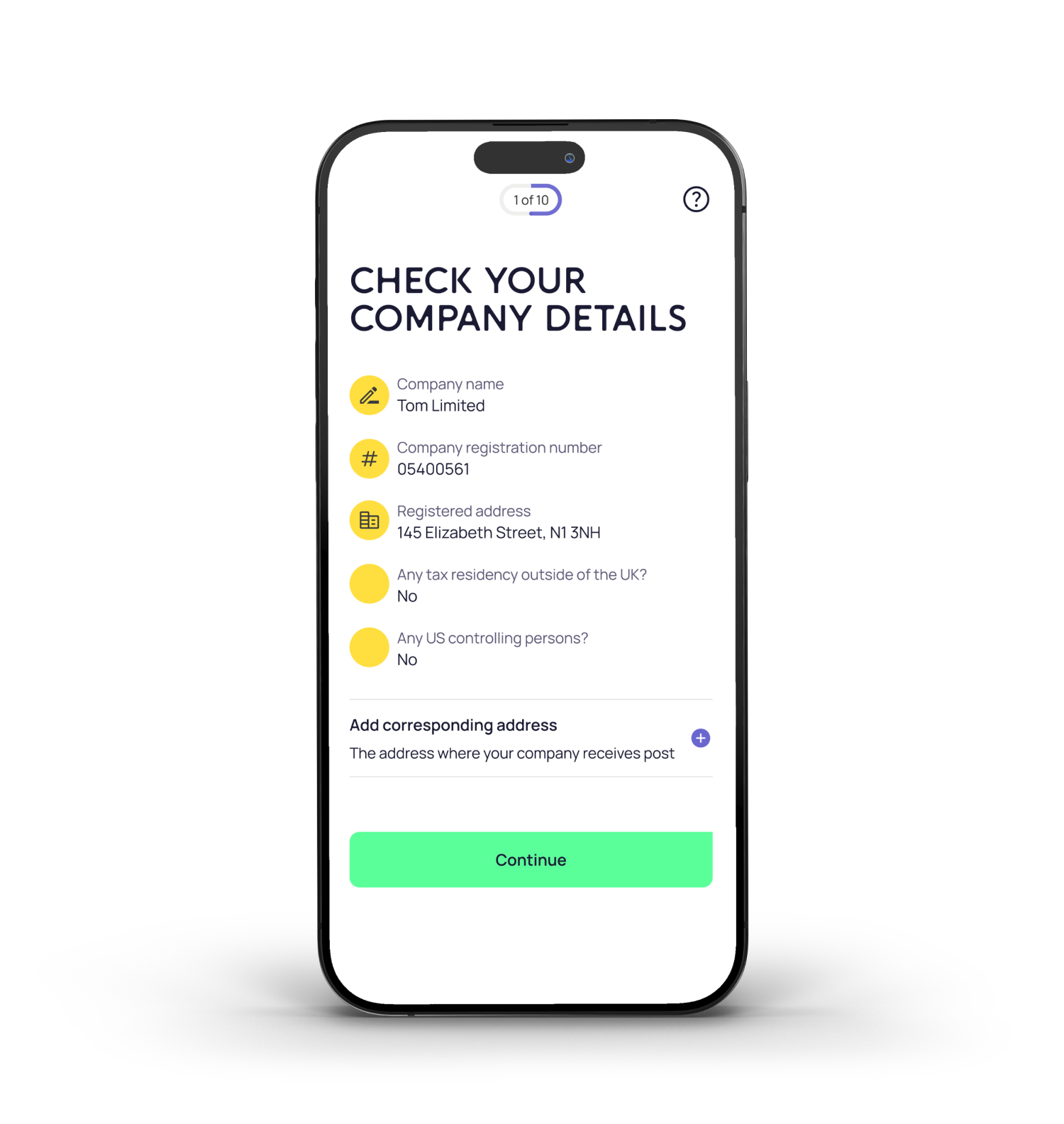

Scaling businesses can’t afford to wait weeks for a bank to catch up. Apply in under 10 minutes and start banking in days—not months. Once you’re a customer, you can open unlimited (free) accounts for separate entities or business needs and seamlessly manage them all under one login.

Set your team up for success by customising your account to suit your business needs, not the other way around. From quick account opening to effortless payment approvals, OakNorth gives you full control over your banking—without the complexity.

You can apply for a business banking account with us if:

By submitting this form you are applying for OakNorth Business Banking and agree to us processing your data as described in our Privacy Notice and Cookie Policy.

OakNorth goes beyond banking—we help businesses turn ambition into achievement with fast, flexible finance. Whether you’re expanding, acquiring, or investing in the future, we provide specialist finance designed for high-growth businesses.

You can apply for an OakNorth business banking account if:

Your company has a turnover of over £1 million or you want to deposit a minimum of £100k

In case of a property company, your company has assets of over £1 million

You are a Director at any one of the following company types: Limited Company, Private Unlimited company, PLC, LLP, Overseas Company or certain types of Private Limited companies.

Your company is registered in the UK with Companies House

Your company has an active status on Companies House

You are aged 18 years or over

You can read more about the eligibility criteria in our terms and conditions.

We aim to open all business accounts within a matter of days. Once you submit your application via the app, we will aim to reach out to you within 48 working hours with an update or if any further information is needed. We’ll then be in touch about the status of your application as soon as we have processed it.

Please keep in mind, account opening times can vary from business to business.

If you want to talk about any opportunity, contact your business partner via ‘Get Help’ section in the App 9 AM to 5 PM, Monday to Friday.

Alternatively, you can find more information on how to contact us here.

All customers who have a business current account automatically get access to an easy-access business savings vault (or Earn vault)

The Earn vault is not offered as a stand-alone product.

† No account fees as of 4th July 2024 but subject to change. ‡ Variable rate correct as of 7th August 2025. § Virtual cards and spending limits coming soon. ****Rate correct as of 7th August 2025. The interest rate for this account is variable and will track the Bank of England Base rate plus or minus a fixed spread (this is the rate that we add or subtract from the Bank of England Base rate). When applying, you will have full clarity on the interest rate (which will include the Bank of England Base rate and the spread). So, if the Bank of England Base rate goes up, your rate will go up; and if the rate comes down, your rate will follow. The interest rate on your account will be updated on the 1st day of each calendar month to reflect the change made to the Bank of England Base rate. Read the Terms and Conditions here.

You understand and acknowledge that the business current account and the mobile app are being provided on an “as is” basis without warranty of any kind. Whilst we will constantly endeavor to improve our product(s), we cannot guarantee that they are free from lags, bugs or a slower than intended response time. Your and our liability in relation to the product is covered in full within the Terms and Conditions. Any communication by an OakNorth business partner is merely a statement of facts and not a recommendation or advice of any kind including with respect to any financial projections, estimates or forecasts related to any product being offered. You are requested to rely on your own analysis before investing/purchasing.

This Visa card is issued by Transact Payments Limited. Transact Payments Limited is authorised and regulated by the Gibraltar Financial Services Commission. Visa is a trademark owned by Visa International Service Association and used under license.

OakNorth Bank plc is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. Financial Services Register number: 629564. The Financial Services Register can be accessed at www.fca.org.uk/register. Registered Office: 57 Broadwick Street, London W1F 9QS, Registered in England No. 08595042.

Key Product Information | Terms and Conditions | FSCS Information Sheet | Privacy Notice