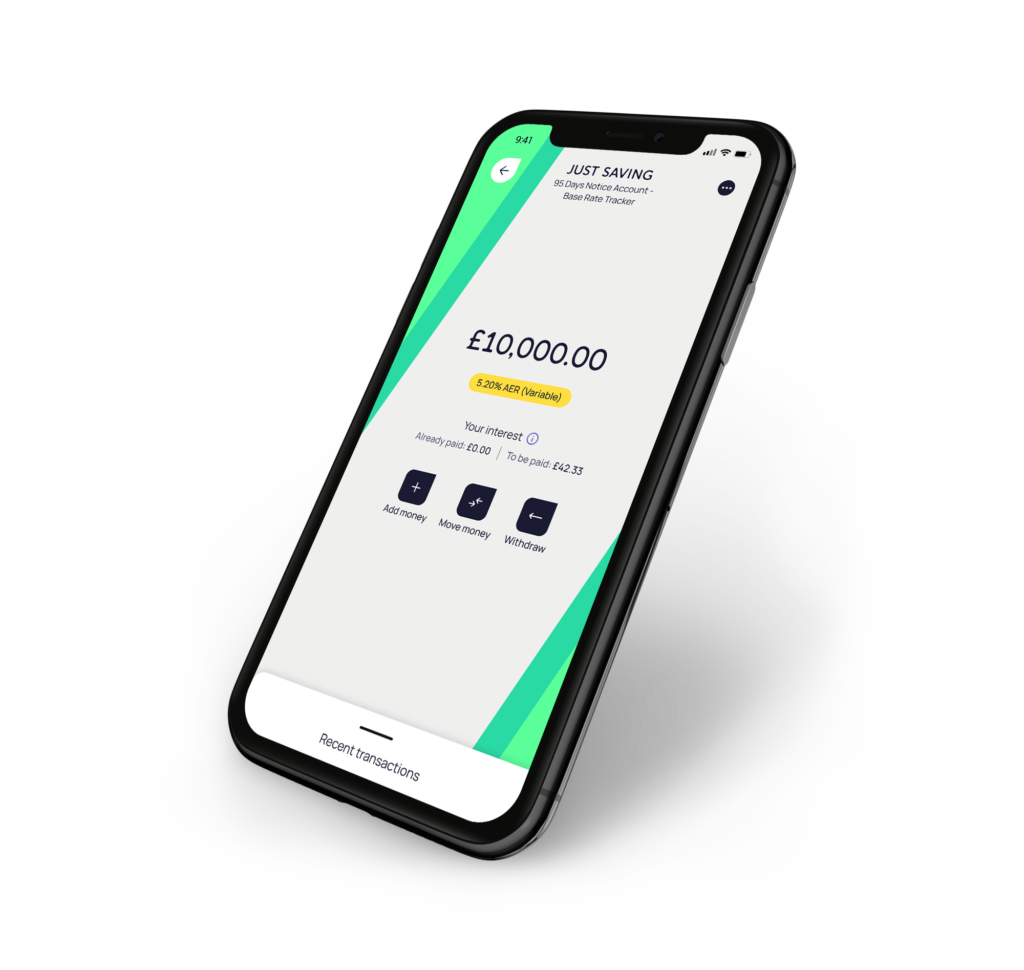

With a Base rate tracker account you can earn higher interest rates without locking your money up long-term. Unlike Fixed Term savings accounts, you just need to let us know 95 days in advance if you need access to your funds. When applying, you will have full clarity on the interest rate (which will include the Bank of England Base rate and the spread).

*The current interest rate is 4.12% AER.

Remember, if the Bank of England Base rate goes up, your rate will go up; and if the rate comes down, your rate will follow. The interest rate on your account will be updated on the 1st day of each calendar month to reflect the change made to the Bank of England Base rate.

You’re not restricted to a set amount of withdrawals. As long as you’ve given us 95 days’ notice, we’ll give you full access to your funds.

You can open an OakNorth Base rate tracker account with just £1

You’ll earn money from us, and we won’t take any fees from you. It’s as simple as that.

Here's the breakdown

The interest rate on our Base rate tracker account will update on the 1st day of each calendar month to reflect the change made to the Bank of England Base rate, which may increase or decrease.

The Financial Conduct Authority (FCA) is a financial services regulator. It requires OakNorth Bank to give you this important information to help you decide whether our Personal Notice Base Rate Tracker Accounts are right for you. You should read this document carefully, together with the General Terms & Conditions and Specific Terms & Conditions for Personal Notice Base Rate Tracker Accounts, so you understand what you are buying, and then keep it safe for future reference.

Scroll down

| Term/Product | Spread* vs Base Rate % | Gross rate (%) | AER (%) | |

|---|---|---|---|---|

| 95 days | 0.12 | 4.04 | 4.12 |

The interest rate tracks the Bank of England (BoE) Base Rate (To view the latest rate visit here) plus a spread* as mentioned above.

To view the current interest rates for all the Issues of our Tracker Notice Accounts, please visit the Notice Base Rate Tracker Account Rate Table on our website.

Your savings account will start generating interest no later than one business day from when we receive and apply your first deposit to your savings account.

Interest is calculated on the minimum daily balance and applied to the account on the first day of every subsequent month.

If a withdrawal request has been made, interest will be calculated on the total amount until, but not including the day of the withdrawal.

*spread in this document refers to the rate that is added or subtracted to the Bank of England Base Rate.

Yes. Interest rates are variable and can be increased or decreased dependent on the Bank of England base rate.

OakNorth may also adjust the spread at any time at our sole discretion as outlined in the Interest Section of our Specific Terms and Conditions- Notice Base Rate Tracker Accounts.

If we change the spread applicable to your interest rate, which results in your interest rate decreasing, we will notify you at least 14 calendar days in addition to the notice period as per the type of account opened, prior to the decrease.

| Term/Product | Initial Deposit at account opening | Balance after 12 months |

|---|---|---|

| 95 days | £1,000 | £1,041.20 |

*These are only examples for illustrative purposes and do not take into account your individual circumstances.

These examples assume that no further deposits or withdrawals are made, that the interest is accrued daily and applied to the account monthly, that any interest earned stays in the account, and that there is no change to the interest rate.

Our accounts are available to individuals, aged 18 or over, who are UK residents (i.e. England, Wales, Northern Ireland and Scotland). Also, you must have a personal UK bank or building society account that allows transfers to be made to and from it.

Applications to open an account must be completed through our website here or via the OakNorth mobile banking app.

The minimum deposit required to open your account is £1. The maximum deposit you may pay into any one Account is £500,000. The maximum amount (excluding the interest) that you will be allowed to hold on deposit with us across multiple accounts is also £500,000.

There is no limit on the number of deposits made into your account. The minimum deposit is £1. The account can continue to receive deposits up to the maximum principal account balance even if the product is withdrawn. We may withdraw a Notice Account issue at any time which means that the product will be closed to new deposit applications.

Once you activate online banking, your account can be managed by logging into the OakNorth mobile banking app or the ‘My Account’ section of our website. Alternatively, you can contact us by email, by phone, or by writing to us. Please refer to our website for our contact details.

Yes. Although, it is subject to giving us notice as per the type of account opened. Withdrawals from your Notice Base Rate Tracker Account to your nominated bank account can be triggered via Online Banking or the mobile app. You can also contact us by email or phone. It is not possible to withdraw money from the account without providing the mandatory period of notice. We may at our discretion allow it in cases of hardship at our sole discretion, which would require suitable documentary evidence. Interest will be calculated on the total amount until, but not including the day of the withdrawal.

There are no limitations on the number of withdrawals. There is a minimum withdrawal amount of £1. After providing notice the funds will be credited back into your nominated account the next business day after the notice period has passed.

If after withdrawing funds where the balance goes to £0, and remains £0 for a period of six months, we can also close your savings account. We will contact you at least 6 weeks before we close it using the email address you gave us. If the account is closed it cannot be reopened, and you will have to create a new account next time.

Interest will be paid gross.

We do not deduct tax from the interest we pay to you. This information is based on our understanding of current taxation which may change in the future.

The AER (Annual Equivalent Rate) illustrates what the interest rate would be if interest was paid and compounded once a year.

Please note: The information provided in the summary box is a summary of the key features of our Base Rate Tracker Notice Accounts. It should not be used as a substitute for our Terms and Conditions which can be found on our website.

If you need quick access to your savings without notice, our Easy Access savings accounts could be a better match for you. Or, if you’re happy to lock your funds away without any immediate access, why not open a Fixed Term account?

If you’re over 18 years old and you’re a resident of the UK – i.e. you have a permanent UK address that you’ve had for over three years – then you’re eligible for an OakNorth notice account. You’ll also need to have a personal UK bank or building society to transfer funds into your account.

You can request to withdraw your savings through online banking or your mobile app. You can also get in touch about this or any other OakNorth Bank account by emailing us at OakNorth Savings or calling on 0330 3801 181.

You’re unable to access your funds without waiting the minimum notice period set out in the terms of your account.

Each notice request is individual and will be paid to your nominated account at the end of the notice period. This cannot be amended. For example on a 35 notice day account, if you decide that 15 days before the funds are due to be withdrawn you want to extend the period by another 10 days, you will have to submit a new request which will then be subject to the normal 35 day notice period.

Yes. Interest rates are variable and can be increased or decreased depending on the Bank of England base rate.

OakNorth Bank may also adjust the spread at any time at our sole discretion as outlined in the Interest Section of our Specific Terms and Conditions – Notice Base Rate Tracker Accounts.

No, this account is only available for sole accounts currently.

You can transfer funds between your Notice account and your Base rate tracker account. Transfers will go through after the notice period has been completed. Read the specific Terms and Conditions of your account to learn more.

The Financial Conduct Authority is a financial services regulator. It requires OakNorth Bank to give you this important information to help you decide whether our Earn Vaults are right for you. You should read this document carefully, together with the Business Current Account Terms & Conditions, so you understand what you are buying, and then keep it safe for future reference

| Term / Product | Gross rate (%) | AER (%) |

|---|---|---|

| “Earn” Vault | 3.78 | 3.85 |

Your account will start generating interest no later than one business day from when we receive and apply your deposit to your OakNorth Bank account. Interest will be calculated and applied on the minimum daily balance and paid on the first day of every subsequent month. Your minimum daily balance is the lowest balance held in your Earn Vault for a given day. If a withdrawal request has been made, interest will be calculated on the total amount until, but not including the day of the withdrawal.

Yes. Interest rates are variable and can be increased or decreased at any time at our sole discretion as outlined in clause 2.4 of our Earn Vault Product Terms & Conditions. If we increase your interest rate, the change will take effect on the next calendar day. In some cases, we will apply this increase with immediate effect. We will also email you about the increase as soon as we can and in any event within 30 calendar days of the change taking effect. If we reduce your interest rate, we will notify you via email at least 14 calendar days prior to the rate change taking effect.

| Term/Product | Initial Deposit at account opening | Balance after 12 months* |

|---|---|---|

| “Earn” Vault | £10,000.00 | £10,385.00 |

*This is only an example for illustrative purposes and does not take into account your individual circumstances.

This example assumes that no further deposits or withdrawals are made, that the interest is accrued daily and applied to the account monthly, that any interest earned stays in the account, and that there is no change to the interest rate.

You can only access your Earn Vault via the mobile app, as explained in the Current Account Terms & Conditions. Your Earn Vault is linked to your current account and will always be available to you. There is no need to open, cancel or close the product. There will be no impact on any customer who does not wish to use the Earn Vault. When you add money to your Earn Vault, this money does not form part of the available balance in your current account. This means:

No minimum or maximum deposit limits apply to your Earn Vault. We do not impose any other limits on your Earn Vault. If this changes, we’ll let you know before they apply.

You can only add money to your Earn Vault from your current account. You can do this via the mobile app at any time. When you add money to your Earn Vault, we will credit your Earn Vault immediately (or in any event within 2 hours).

You may access your balance and details of money added or withdrawn from your Earn Vault through the mobile app.

You can trigger a withdrawal from your Earn Vault to your current account via the mobile app at any time.

There is no minimum withdrawal amount. However, you can only withdraw up to the balance of your Earn Vault. If you attempt to withdraw more than this, we will reject your request.

If we receive your withdrawal request on a business day before 8am, we will move the money to your current account on the same day. If your request is received on a business day after 8am, we will move the money to your current account on the next business day.

If we receive your withdrawal request on a non-business day, we will move the money to your current account on the next business day. If you make a withdrawal request, we will calculate interest on the total balance amount until, but not including, the day of the withdrawal.

If we suspend your current account, we will also suspend your access to the Earn Vault.

If you no longer want to use your Earn Vault, you do not need to ask us to “close” it. As long as you hold a current account with us, you can start using your Earn Vault again at any time and these Earn Terms & Conditions shall apply.

If you or we decide to close your current account and end your agreement with us, we will move the money in your Earn Vault back to your current account. We will then follow the process outlined in your current account T&Cs to return any money we owe to you.

Please note: The information provided in the summary box, is a summary of the key features of our Earn Vault accounts. It should not be used as a substitute for our Terms and Conditions.