Our lending extends to all sorts of companies located across the country, led by members of our team with expert industry knowledge. Having worked on many of our private equity-backed loans, our Director of Debt Finance Stewart Haworth looks back on some of the businesses we’ve helped to support.

I’m pleased to have contributed to many exciting loans across Northern England, lending to a range of businesses, from restaurants and manufacturers to consumer debt management companies and education platform providers. Here I’m taking a closer look at the deals I’ve brought together, including several private equity loans on which we’ve worked with some fantastic partners to provide.

Omniplex Learning

Workplace learning platforms can be preconceived as a dull chore to be done as jobs increasingly have more red tape around them. But as compliance requirements change, platforms that can shake this perception and provide engaging content and of real use can capture a large new customer base.

Omniplex Learning has multiple learning management systems and tools that are used by big businesses like Pfizer, easyJet and ASOS and are growing at over 60% year on year. Having already taken on investment from LDC in 2020 to complete acquisitions of additional tools for its portfolio, the £3m loan from OakNorth will be used for refinancing to support investment in a new head office and to propel their future growth.

Mowgli Street Food Restaurants

A fast-growing, exciting new contender on the casual dining scene, Mowgli Street Food has been shaking up the Indian food scene in the UK since 2014. Lawyer-turned-chef Nisha Katona decided to take her passion for fast home-style Indian cuisine and opened the first Mowgli restaurant in Liverpool. Now with several cookbooks and over 15 locations under her belt, Nisha is getting ready to propel her business forward to its next stage of growth by taking on private investment.

Our £14.5m loan powered in partnership with TriSpan will help boost Mowgli in several key areas. With multiple new locations lined up for imminent launches, this will assist with their immediate growth plans. The loan will also allow previous financing partners Foresight Group to exit and to change the direction of management as the brand sets its sights on the future.

TriSpan also has its own Rising Stars Fund, a dedicated programme focused on providing private equity investment to restaurant businesses with promising growth potential. So Mowgli will benefit from an investment partner with strong knowledge and interest in the hospitality industry.

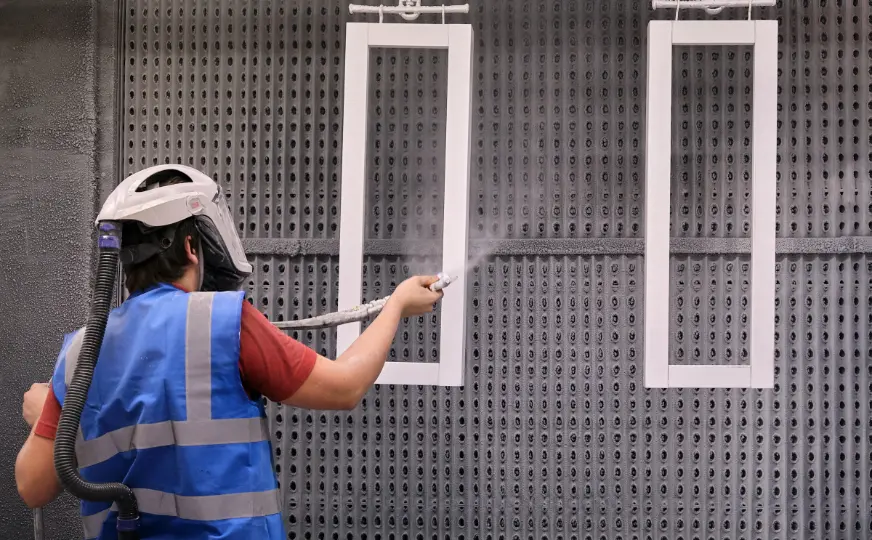

Sentry Doors

Established in the late eighties, Sentry Doors have been producing timber fire and security door sets and screens for both commercial and residential use. Manufacturers like Sentry, with a strong product offering and experienced management teams, are in a great position to build, and that was exactly the reason they sought out additional funding in 2022.

The Doncaster-based team acquired E. & S. W. Knowles & Company earlier in the year, which also specialises in bespoke door supply to several industries, including hotels, student accommodation and healthcare. Private equity investment firm Cairngorm Capital backed Sentry with a financing package to complete the acquisition, and OakNorth further supported Sentry with a loan of £14.3m for its continued growth plans. This was a loan I was particularly pleased to oversee as it’s great to see the UK manufacturing industry not only surviving but thriving. The fact that it is also within specialised safety equipment is a good marker for the state of UK manufacturing in the future too.

MoneyPlus

As managing finances becomes a greater worry and strain for many people, the rise in individuals accessing debt advisory services is also growing. Manchester-based MoneyPlus provides both legal and financial advice to individuals across the UK and is seeing the demand for its services dramatically increase.

Having received funding from investment partner Intriva Capital in 2021, our £6.5m loan in 2022 is further boosting their abilities to help more people with the financial help they need. The cash injection will go towards growing their staff to reach more people, as well as expanding their services to support customers with multiple issues they may be facing.

If you’re a growing business looking to take on your next project, OakNorth is a bank backing companies across the UK, including many loans I have worked on around the North West. Feel free to reach out to me directly via email at [email protected] or by checking out our business loans page.

by Stewart Haworth, Director of Debt Finance at OakNorth Bank