This prize draw has now closed

If you opened and funded an Easy Access Tracker account during the qualifying period and met the entry criteria, we’ll be in touch directly if you’re a winner.

If you opened and funded an Easy Access Tracker account during the qualifying period and met the entry criteria, we’ll be in touch directly if you’re a winner.

Deposit £2,000 to a new or existing Easy Access Tracker account between 18 August 2025 to 31 October 2025.

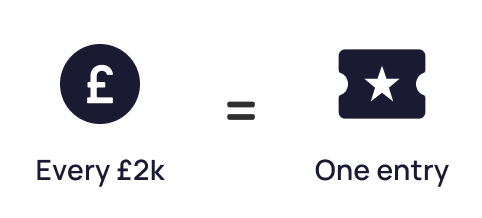

Every extra £2,000 you deposit and hold until 28 February 2026 gives you another entry. It’s not essential, but it gives you more chances to win.

Hold at least £4,000 or more in your account through to 28 February 2026 to remain eligible. This can include deposits made prior to the promotional period.

Winners will be chosen at random and contacted by phone or email. The more you save, the better your chances.

Names will be drawn at random – so the more you save, the more chances you’ll have to win. Winners will be contacted in March via phone or email.

You’ll get one entry for every incremental £2,000 you deposit before 31 October and hold in your account until 28 February 2026. So if you deposit £2,000, then add £4,000 later during the deposit period, that’s three entries.

Types of savings accounts:

Filters

Types of savings accounts:

Term

AER

Min. deposit

Withdrawals

The Financial Conduct Authority is a financial services regulator. It requires OakNorth Bank to give you this important information to help you decide whether our Personal Easy Access Tracker Accounts are right for you. You should read this document carefully, together with the General Terms & Conditions and Specific Terms & Conditions for Personal Easy Access Tracker Accounts, so you understand what you are buying, and then keep it safe for future reference.

You should scroll down and read all information below carefully before you apply.

Scroll down

| Term/Product | Spread* vs Base Rate % | Gross rate (%) | AER (%) | |

|---|---|---|---|---|

| Next-day access | -0.20 | 3.49 | 3.55 |

The interest rate tracks the Bank of England (BoE) Base Rate (To view the latest rate visit here) plus/ minus a spread* as mentioned above.

Your account will start generating interest no later than one business day from when we receive and apply your deposit to your OakNorth Bank account.

Interest is calculated on the minimum daily balance and applied to the account on the first day of every subsequent month.

If a withdrawal request has been made, interest will be calculated on the total amount until, but not including the day of the withdrawal.

*spread in this document refers to the rate that is added or subtracted to the Bank of England Base Rate

Yes. Interest rates are variable and can be increased or decreased dependent on the Bank of England base rate.

OakNorth may also adjust the spread at any time at our sole discretion as outlined in the Interest Section of our Specific Terms and Conditions – Easy Access Tracker Account.

If we change the interest rate spread on your savings account, which results in your interest rate increasing, we will email you about this increase and confirm the date of the change taking effect. If we change the spread applicable to your interest rate, which results in your interest rate decreasing, we will notify you at least 14 calendar days prior to the decrease.

| Term/Product | Initial Deposit at account opening | Balance after 12 months |

|---|---|---|

| Next-day access | £1,000 | £1,035.50 |

*This is only an example for illustrative purposes and does not take into account your individual circumstances.

This example is based on the reference interest rate as it stood at the time the projection was made and assumes that no further deposits or withdrawals are made, that the interest is accrued daily and applied to the account monthly, that any interest earned stays in the account, and that there is no change to the reference interest rate or spread.

Our accounts are available to individuals, aged 18 or over, who are UK residents (i.e. England, Wales, Northern Ireland and Scotland). Also, you must have a personal UK bank or building society account that allows transfers to be made to and from it.

Applications to open an account must be completed through our website here or via the OakNorth mobile banking app.

The minimum deposit required for the account is £1. The maximum deposit you may pay into any one account is £500,000. The maximum amount (excluding the interest) that you will be allowed to hold on deposit with us across multiple accounts is also £500,000.

You can deposit funds into your account up to the maximum principal account balance as set out above even if the product is withdrawn. We may withdraw an Easy Access Tracker product at any time and without notice which means that the product will be closed to new deposit applications.

Once you activate online banking, your account can be managed by logging into the OakNorth mobile banking app or through the ‘My Account’ section of our website. Alternatively, you can contact us by email, by phone, or by writing to us. Please refer to our website for our contact details.

Yes. There is no term for a Personal Easy Access Tracker account and no limitation on the number of withdrawals.

There is a minimum withdrawal amount of £1. No notice of withdrawal is required and withdrawal requests can be made at any time. The funds will be credited back into your nominated account the next business day, or within 2 business days if the request is received on a non-business day such as a Saturday, Sunday, or a Bank holiday.

Withdrawals can be triggered via Online Banking or the mobile app. You can also contact us by email or phone.

If after withdrawing funds where the balance goes to £0, and remains £0 for a period of six months, we can also close your savings account. We will contact you at least 6 weeks before we close it using the email address you gave us. If the account is closed it cannot be reopened, and you will have to create a new account next time.

Interest will be paid gross.

We do not deduct tax from the interest we pay to you. This information is based on our understanding of current taxation which may change in the future.

The AER (Annual Equivalent Rate) illustrates what the interest rate would be if interest was paid and compounded once a year.

Please note: The information provided in the summary box, is a summary of the key features of our Personal Easy Access Tracker accounts. It should not be used as a substitute for our Terms and Conditions which can be found on our website.

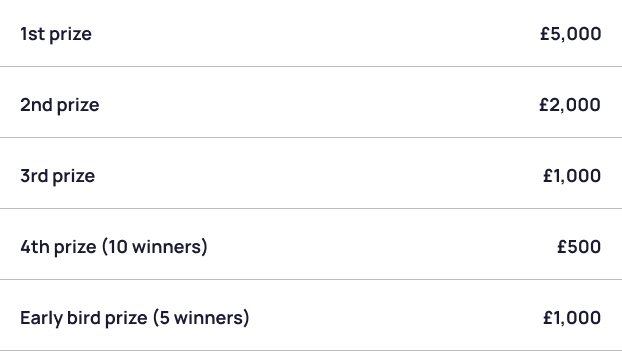

Deposit £2,000 into your Easy Access Tracker account by 30 September, and you’ll be entered into our early bird draw. With five extra prizes of £1,000 up for grabs, it’s our way of saying thanks to customers who start saving sooner. Remember, you’ll also need to keep at least £4,000 in your account until 28 February to be eligible.

Earn a variable rate that tracks the Bank of England base rate.

Access your money when you need it, with next-business day withdrawals.

Open your account with just £1, and top up whenever it suits you.

No, you can use an existing OakNorth Easy Access Tracker account, as long as you deposit at least £2,000 between 18 August and 31 October and maintain the balance criteria till 28 February.

Only deposits that remain in your account until 28 February 2026 will count towards your entries. You need to maintain at least £4,000 in your account to be eligible.

Each £2,000 of net incremental deposits you make and hold during the promotion equals one entry. For example, if you deposit £8,000 and withdraw £2,000 during the campaign period, your net deposit would be £6,000 – qualifying you for three prize draw entries. There is no limit to the number of entries you can earn, but you can only win one prize.

Each customer can receive a maximum of one early bird entry, even if you deposit more than £2,000 before 30 September 2025. However, you can earn multiple entries into the main prize draw – one for every £2,000 of net incremental deposits you make and hold during the promotion period. Remember, at least £4,000 will need to remain in the account until 28 February 2026 in order to be eligible for early bird and main prize draws.

Each participant is eligible to win only one prize as outlined in the Terms and Conditions of the promotion. In the event that a participant is selected as a winner in more than one category, they will be awarded only the prize with the highest monetary value. The prize in the other category/categories will be reallocated to the next eligible participant(s).

All winners – including those entered into the early bird draw – will be selected at random and contacted by OakNorth in March 2026 via phone or email.

Read full terms and conditions.

If after reviewing the terms and conditions you would like to opt out of the prize draw, please contact us prior to the draw date.