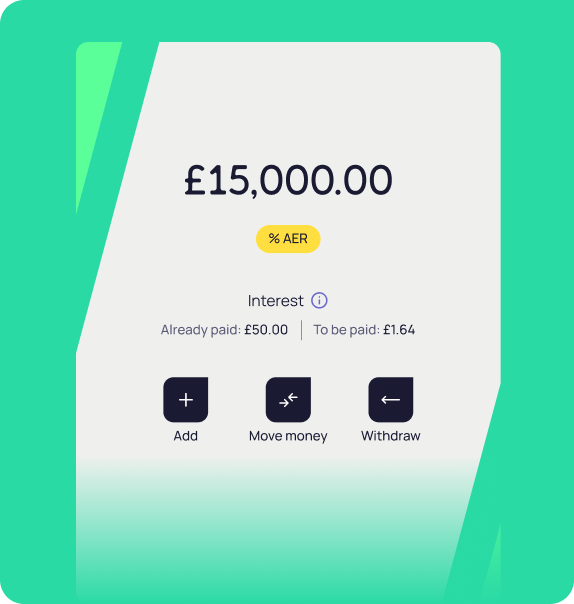

Personal Savings

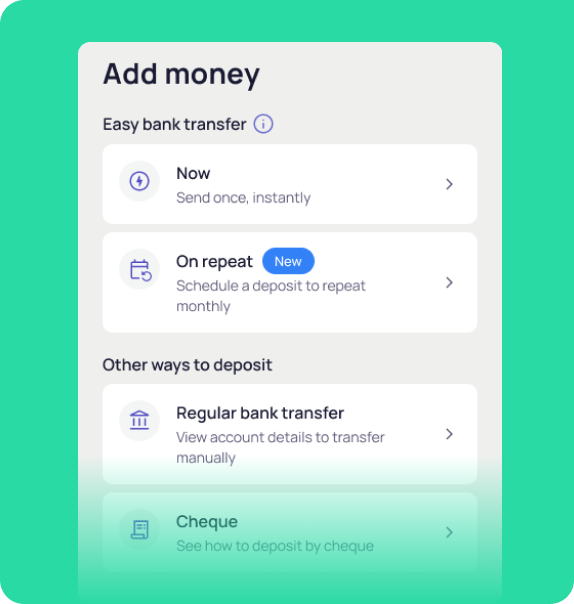

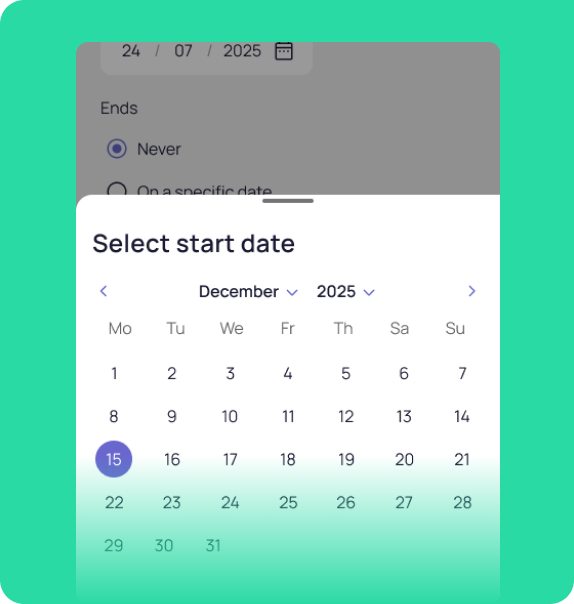

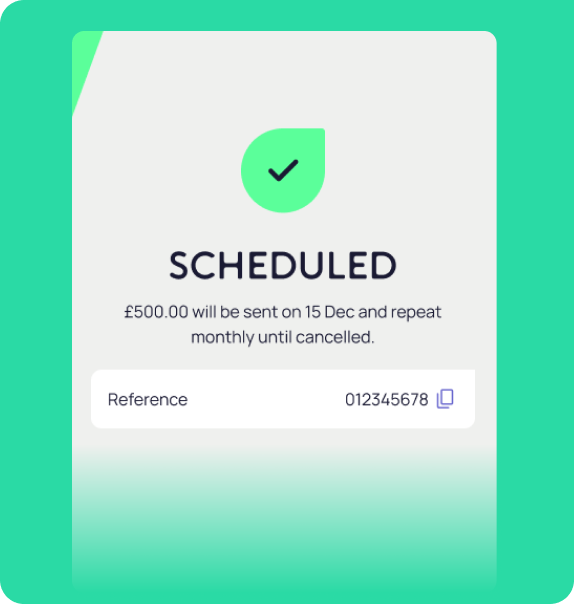

PUT YOUR SAVINGS ON AUTOPILOT

Set up a scheduled payment to repeat each month so your money moves automatically and you don’t have to lift a finger.

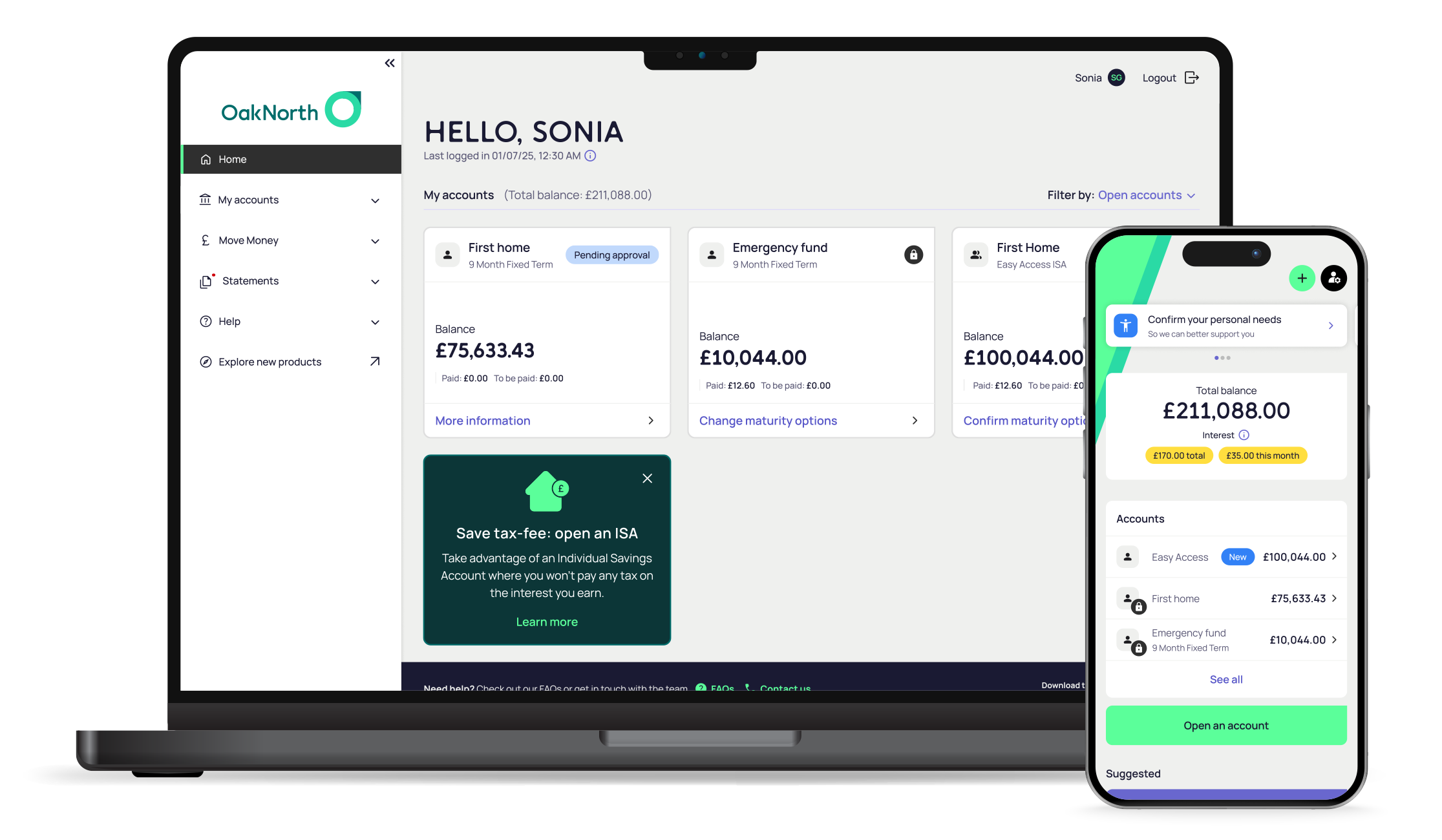

Currently only available in the OakNorth app for Easy Access and Notice accounts. Your eligible deposits are protected up to £120,000 by the FSCS.