It’s always important to have a nest egg to fall back on, but it can be hard to make these savings a priority and keep track of them. And in a time where we’re all spending many more hours on our phones, why not take a few minutes to get on top of your savings through your banking app?

Our banking app is already a hit with our customers with a 4.8 rating on the App Store, and 4.7 on the Google Play Store, but there may be some features you’re unaware of that can really help your relationship with your savings and help you feel better connected to your money. Make sure you’re taking full advantage of these handy features to keep on top of your goals.

Seamless account opening – your savings sorted sooner

We want to make great savings accounts available to the masses, which is why our accounts can be opened quickly and easily. New accounts can be applied for and opened quickly, and all completed from inside the app, making getting your savings sorted a breeze.

We’ve built our app this way to reduce your journey to secure savings, so once you’ve decided on the right account for you, you can fund it and watch your savings grow. And with an initial account setup, it’s then even faster if you decide to open another of our accounts.*

Whether fixed term accounts are your thing or you prefer the way a notice account can suit your changing savings goals, you can find the details of all our different accounts in our personal savings page.

*applicable to balances under £500,000

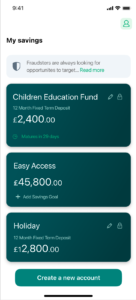

Name your accounts to match your goals

Ever looked at a savings account with a soulless series of random numbers and felt removed from the end goal? It can be hard enough to keep yourself motivated on a savings journey, so any small reminder of what all your efforts are for can help make all the difference when you next come to top up.

Our savings accounts have the option for personalisation, so whether you’re building towards a house deposit or your next big trip away, you can name your account to help keep this in your mind. So if you’re reminded of your goal regularly, you may think twice about withdrawing from your account, and perhaps even be more motivated to add to your savings in your Easy Access or Notice accounts and keep pushing towards your bigger goals.

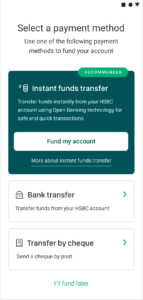

Instant account funding – money into and across accounts quicker

Our instant account funding option within the app allows you to link your savings account directly to your bank account, making it easier to fund your savings. You can also move savings between your OakNorth accounts,* so you can get your money to where you need it at a pace that keeps up with you.

The faster you fund your account, the quicker you start earning your interest. And if you decide that your cash would be better sitting in a different account, you won’t be held back from moving your savings to where it’s convenient for you.*

*subject to the terms of your account

Streamlined accounts, easily displayed together

Sometimes the biggest hurdle to financial control can be knowing what money is where. You may have a few different savings accounts with different providers and struggle to keep track of them. And without a clear picture of how much you already have saved and for what purposes, you may not be making the best choices as to where you save your money next.

With the opportunity to see all of your OakNorth savings accounts in the palm of your hand, it can make the decision as to where you next save your money much clearer for you. Within the OakNorth app you can see all of your accounts alongside details of the interest rate you’re earning and the dates at which you will next be able to access your money for accounts such as Fixed Term and Fixed Rate ISAs.

Accountability built in to your goals

We believe that staying within touching distance of your savings makes a huge impact on how much you’re capable of saving, and how better to do that than via an app when so many transactions are now carried out by smartphones?

With studies showing two-thirds of UK consumers reporting their savings had gone up since they began using a savings app, we’re all for bringing our customers and their savings closer together to help keep them aligned with their goals. Access through an app makes it easy to check on your balance, add to your savings and open new accounts. And notifications keep you connected to your savings even when you’re not actively using the app.

Using our app is a great additional way to feel on top of your savings every day. With competitive rates on our fixed term savings accounts and notice accounts and a huge suite of different savings accounts to suit your savings goals, you can set up the right account for you and stay on top of your savings plans easily all from within your phone.