Business Banking

Banking That Means Business

Power your high-growth business with banking that blends industry know-how and tech innovation.

Business Banking

Power your high-growth business with banking that blends industry know-how and tech innovation.

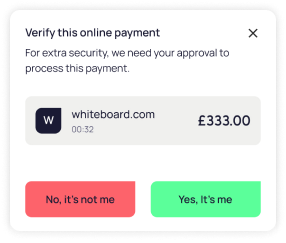

Scale at speed with our business current accounts, business savings of up to 3.75% AER*, free Visa debit cards, zero account fees, and much more.

Exclusive benefits

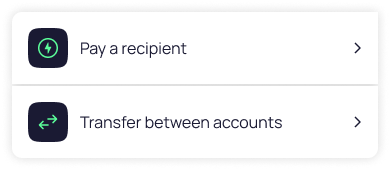

Spend | Business current account

Earn | Savings

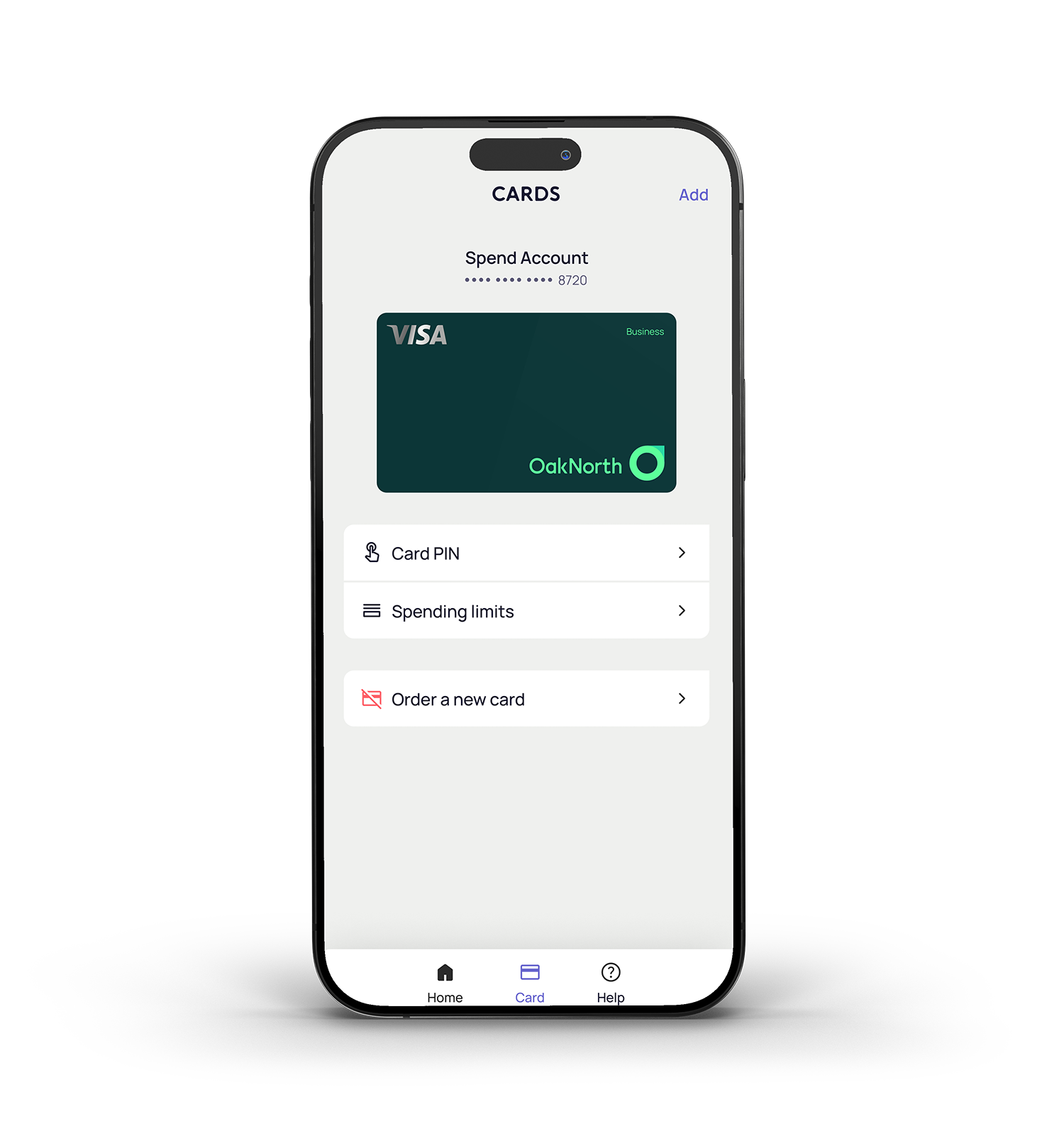

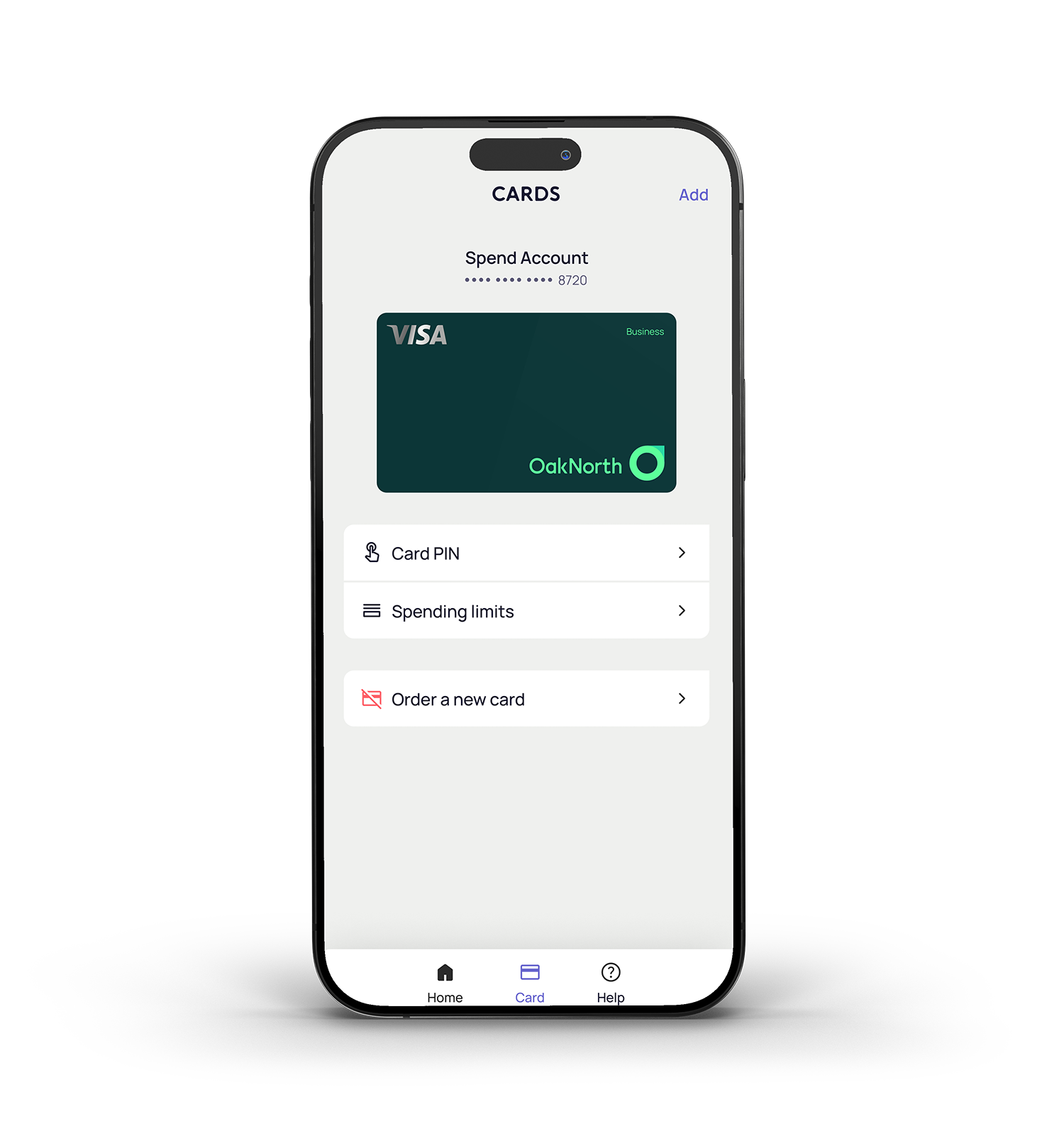

Debit cards | Visa business

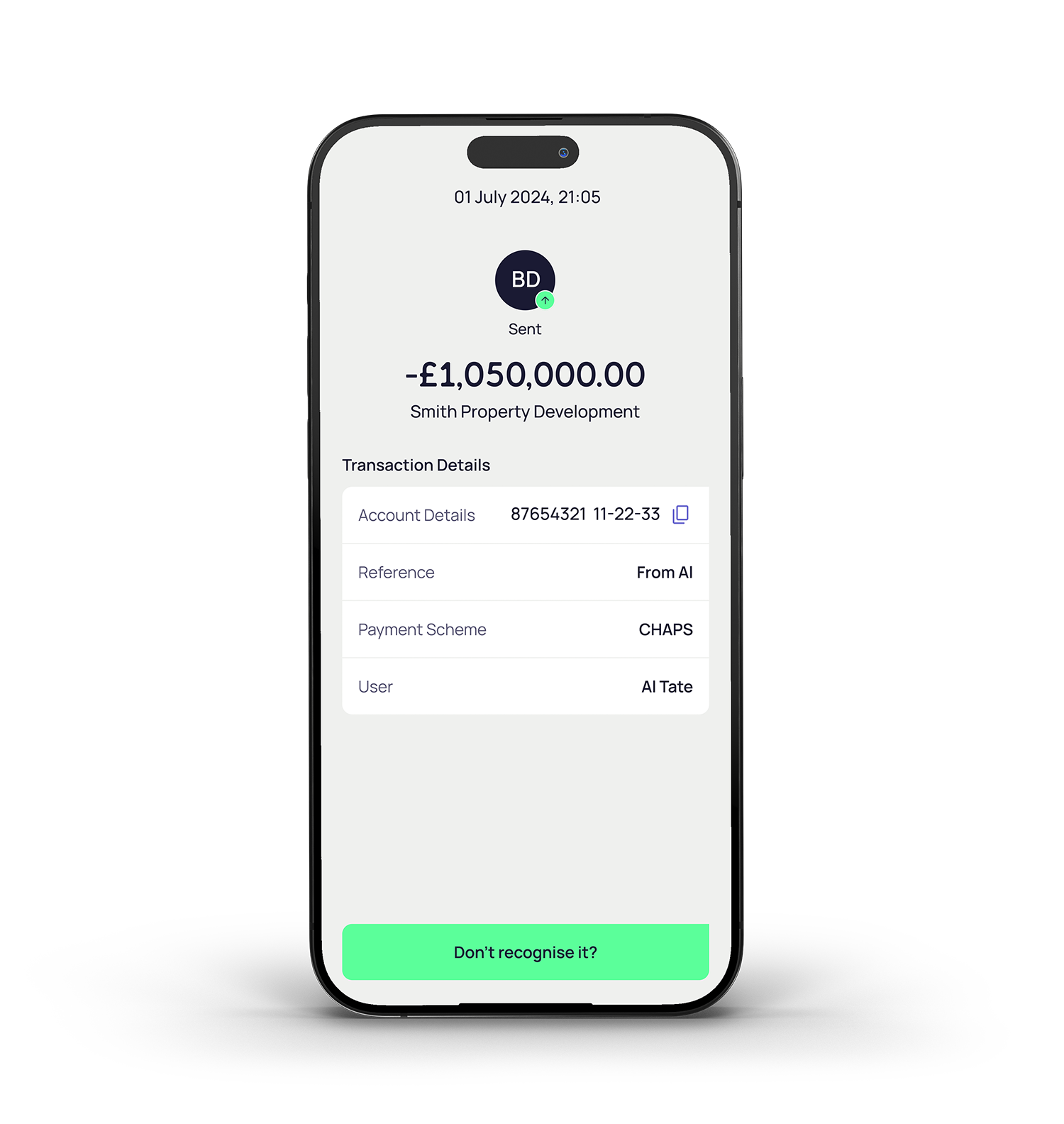

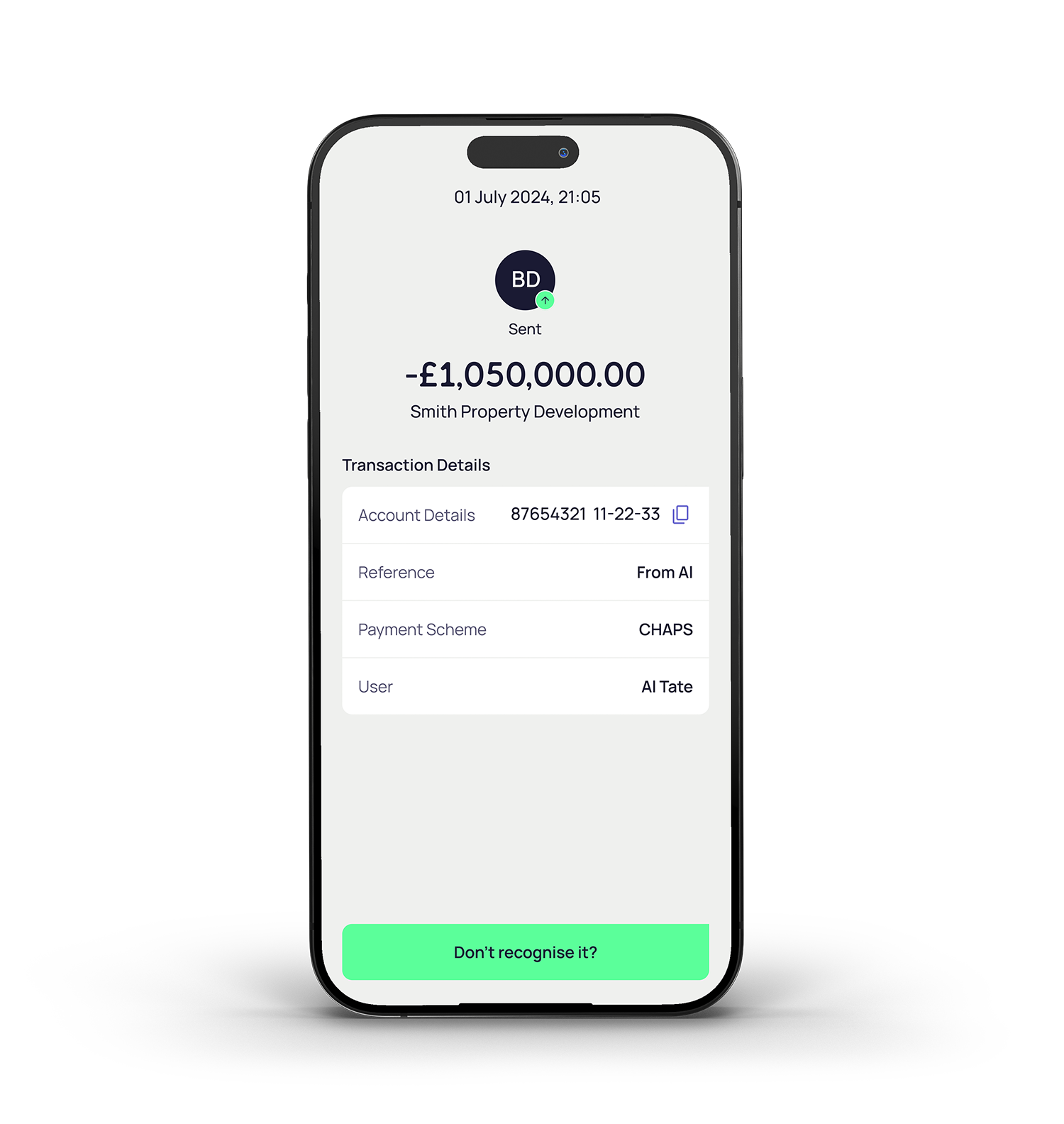

Manage | Your money and business

By submitting this form you are applying for OakNorth Business Banking and agree to us processing your data as described in our Privacy Notice and Cookie Policy. Read the full Terms and Conditions.

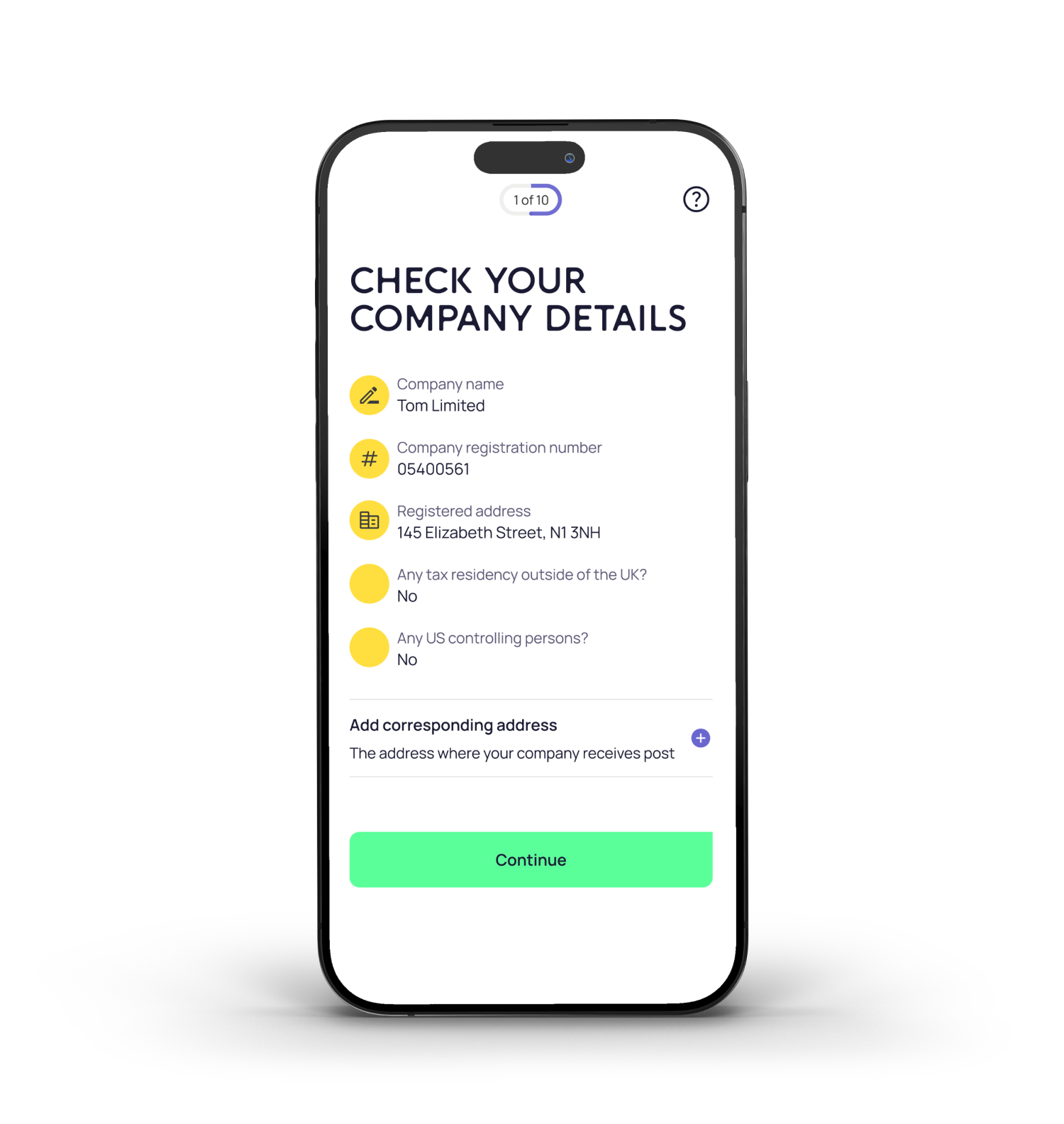

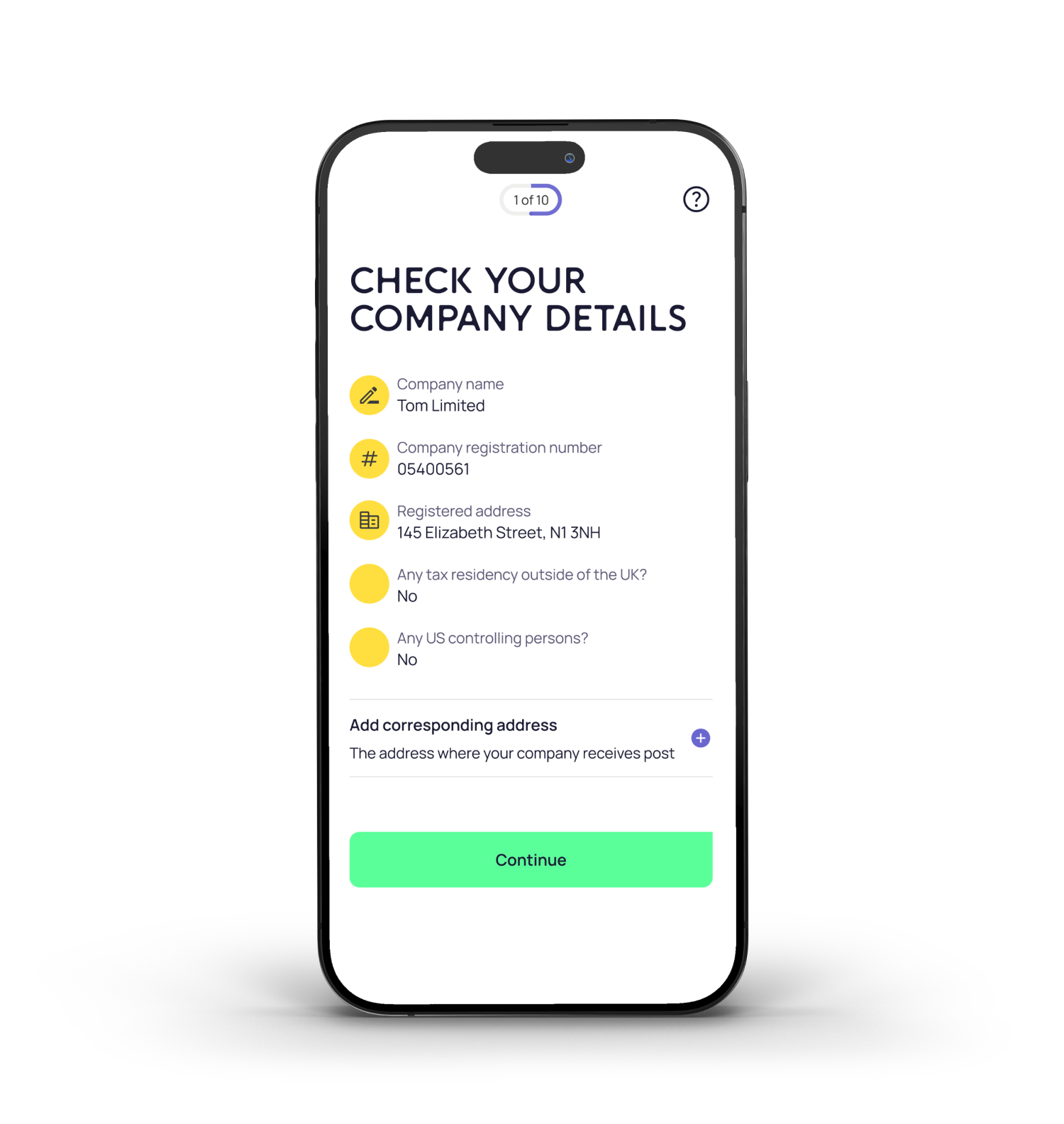

We aim to open all business accounts within a matter of days. Once you submit your application via the app, we will aim to reach out to you within 48 working hours with an update or if any further information is needed. We’ll then be in touch about the status of your application as soon as we have processed it.

Please keep in mind, account opening times can vary from business to business.

If you want to talk about any opportunity, contact your business partner via ‘Get Help’ section in the App 9 AM to 5 PM, Monday to Friday.

Alternatively, you can find more information on how to contact us here.

All customers who have a business current account automatically get access to an easy-access business savings vault (or Earn vault)

The Earn vault is not offered as a stand-alone product.

† No account fees as of 4th July 2024 but subject to change. ‡ Variable rate correct as of 18th December 2025. ****Rate correct as of 18th December 2025. The interest rate for this account is variable and will track the Bank of England Base rate plus or minus a fixed spread (this is the rate that we add or subtract from the Bank of England Base rate). When applying, you will have full clarity on the interest rate (which will include the Bank of England Base rate and the spread). So, if the Bank of England Base rate goes up, your rate will go up; and if the rate comes down, your rate will follow. The interest rate on your account will be updated on the same day to reflect the change made to the Bank of England Base rate. Interest is paid on your whole balance once it exceeds £100,000. Balances of £99,999 and under do not earn interest. Read the Terms and Conditions here.

You understand and acknowledge that the business current account and the mobile app are being provided on an “as is” basis without warranty of any kind. Whilst we will constantly endeavor to improve our product(s), we cannot guarantee that they are free from lags, bugs or a slower than intended response time. Your and our liability in relation to the product is covered in full within the Terms and Conditions. Any communication by an OakNorth business partner is merely a statement of facts and not a recommendation or advice of any kind including with respect to any financial projections, estimates or forecasts related to any product being offered. You are requested to rely on your own analysis before investing/purchasing.

This Visa card is issued by Transact Payments Limited. Transact Payments Limited is authorised and regulated by the Gibraltar Financial Services Commission. Visa is a trademark owned by Visa International Service Association and used under license.

OakNorth Bank plc is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. Financial Services Register number: 629564. The Financial Services Register can be accessed at www.fca.org.uk/register. Registered Office: 57 Broadwick Street, London W1F 9QS, Registered in England No. 08595042.

Key Product Information | Terms and Conditions | FSCS Information Sheet | Privacy Notice