Notes

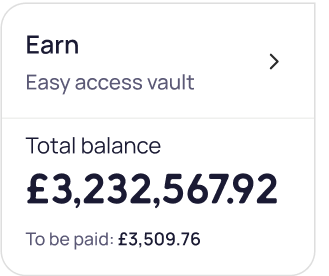

† No account fees as of 4th July 2024 but subject to change. ‡ Variable rate correct as of 7th August 2025. ****Rate correct as of 9th October 2025. The interest rate for this account is variable and will track the Bank of England Base rate plus or minus a fixed spread (this is the rate that we add or subtract from the Bank of England Base rate). When applying, you will have full clarity on the interest rate (which will include the Bank of England Base rate and the spread). So, if the Bank of England Base rate goes up, your rate will go up; and if the rate comes down, your rate will follow. he interest rate on your account will be updated on the same day to reflect the change made to the Bank of England Base rate. Interest is paid on your whole balance once it exceeds £100,000. Balances of £99,999 and under do not earn interest. Read the Terms and Conditions here.

You understand and acknowledge that the business current account and the mobile app are being provided on an “as is” basis without warranty of any kind. Whilst we will constantly endeavor to improve our product(s), we cannot guarantee that they are free from lags, bugs or a slower than intended response time. Your and our liability in relation to the product is covered in full within the Terms and Conditions. Any communication by an OakNorth business partner is merely a statement of facts and not a recommendation or advice of any kind including with respect to any financial projections, estimates or forecasts related to any product being offered. You are requested to rely on your own analysis before investing/purchasing.

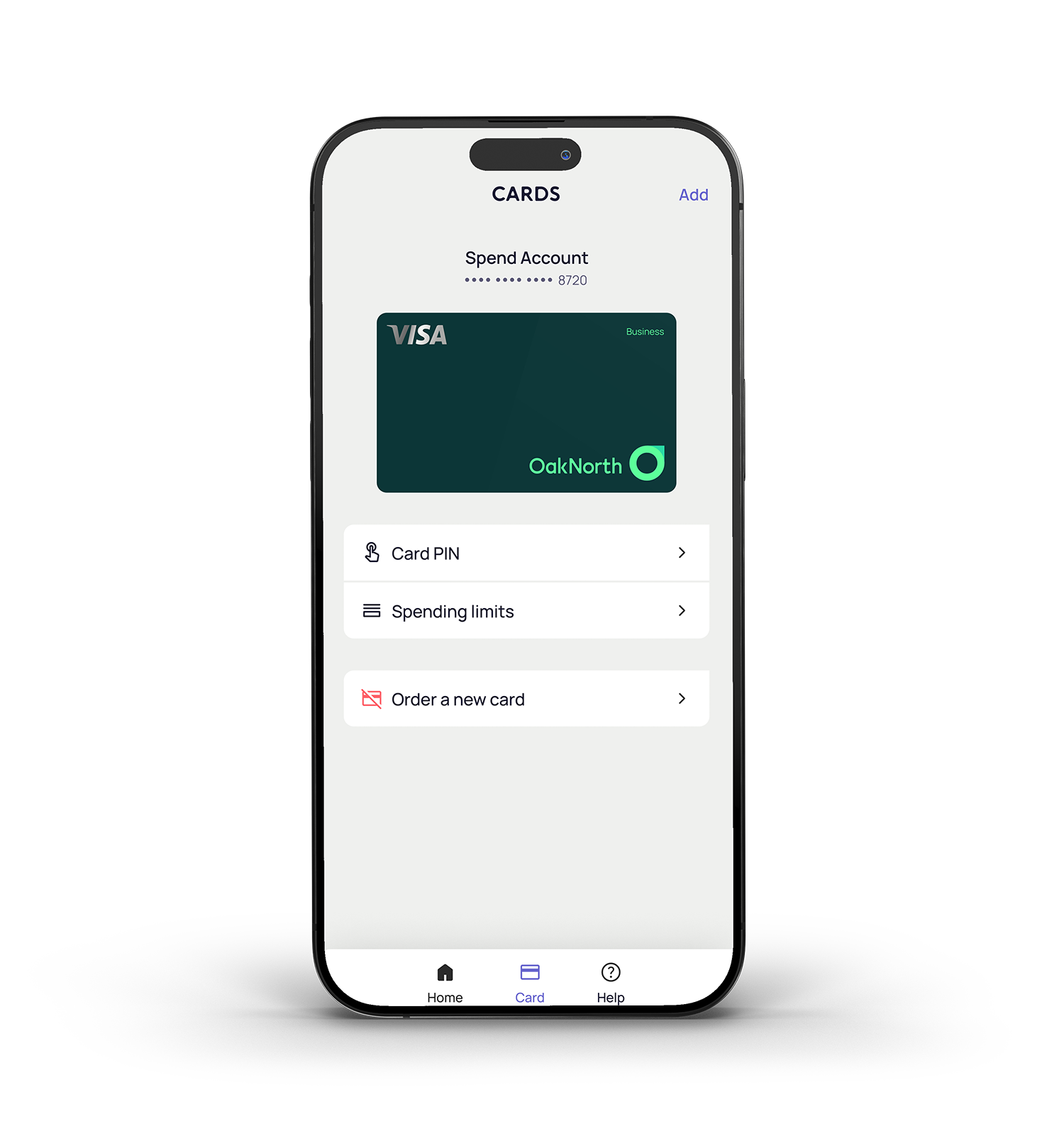

This Visa card is issued by Transact Payments Limited. Transact Payments Limited is authorised and regulated by the Gibraltar Financial Services Commission. Visa is a trademark owned by Visa International Service Association and used under license.

OakNorth Bank plc is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. Financial Services Register number: 629564. The Financial Services Register can be accessed at www.fca.org.uk/register. Registered Office: 57 Broadwick Street, London W1F 9QS, Registered in England No. 08595042.

Key Product Information | Terms and Conditions | FSCS Information Sheet | Privacy Notice