Tuesday November 11th, 2025

Is my money safe? Understanding FSCS protection for UK savings accounts

What is FSCS protection for savings accounts in the UK?

If you’ve ever asked, “Is my money safe in the bank?”, the Financial Services Compensation Scheme (FSCS) provides the UK’s official answer.

FSCS protection is an independent government-backed guarantee service that keeps your eligible savings safe up to a certain limit if a UK-authorised bank, building society, or credit union fails. It’s designed to give you some peace of mind that your money won’t disappear if something unexpected happens to your financial provider.

In short: The FSCS covers up to £120,000 per eligible person, per authorised bank. Joint accounts are also eligible for FSCS protection up to the same limit of £120,000 per person. All your eligible deposits at the same bank are “aggregated” and the total is subject to the limit of £120,000.

Why does the FSCS exist?

The Financial Services Compensation Scheme was set up by the UK Government in 2001 as an independent service to protect customers of authorised financial firms. Its purpose is to:

- Protect consumers if a financial firm fails

- Maintain trust in the UK banking system

Compensate savers quickly and automatically, anything from 7 to 20 working days of a Bank or Building Society failing, according to the FCSC.

Whilst independent, the FSCS is funded by regulated financial firms. It operates under the oversight of the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA), the same regulators that supervise OakNorth Bank.

That means your eligible savings with OakNorth are protected up to the FSCS limits.

How much does FSCS protection cover?

The standard FSCS protection limit is:

This means that if your savings are held with one authorised bank, you’re covered up to £120,000 per person in total. If you hold accounts with multiple brands under the same banking licence, your combined protection is still limited to £120,000 across that group.

When you save with OakNorth as an authorised and regulated UK Bank, this protection applies automatically, no registration or action is needed.

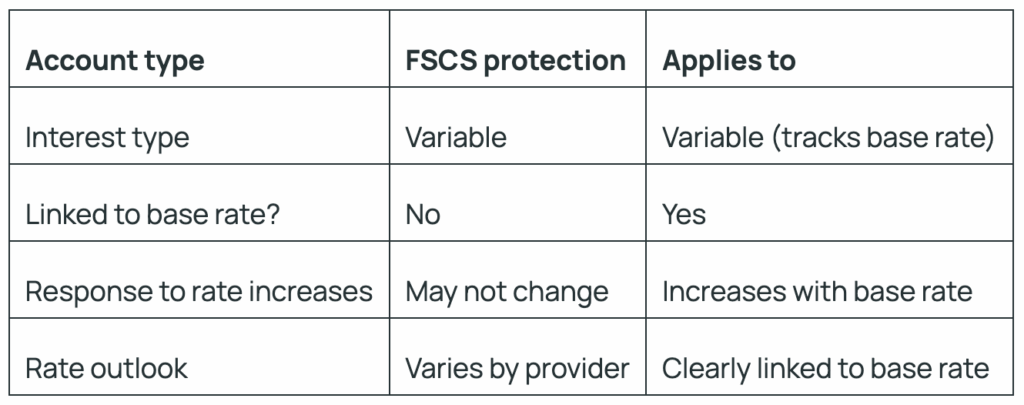

Which types of savings accounts are covered?

FSCS protection applies to most personal and business savings UK bank accounts held with UK-authorised institutions.

Covered by FSCS:

- Fixed term savings accounts

- Easy access accounts

- Notice accounts

- Cash ISAs

- Business savings accounts

Not covered by FSCS:

- Investments, stocks or shares (see FSCS for the eligibility criteria which may cover some investments in the event of a firm failing).

- Crypto-assets or e-money wallets

- Peer-to-peer lending platforms

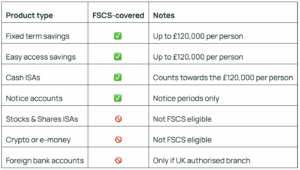

All OakNorth savings products, including Fixed Term, Easy Access Tracker, Notice and Notice Base Rate Tracker, Simple Saver and Fixed Rate Cash ISA accounts, are FSCS-protected up to £120,000 per eligible person.

What happens if my bank fails?

If a UK bank, building society or credit union fails, FSCS protection activates automatically. You don’t need to make a claim.

Here’s what happens:

- FSCS confirms your balance and eligibility.

- You’re compensated up to the £120,000 limit per person per eligible deposit.

- The money is paid to your nominated account, as soon as within seven working days.

For example, when Icesave and Bradford & Bingley collapsed in 2008, FSCS repaid millions of savers directly, proving that the system works when it’s needed most.

How to check if your savings are FSCS protected

It’s quick and easy to confirm whether your bank or savings provider is covered by FSCS:

- Visit the FSCS website.

- Enter your bank’s name (e.g. OakNorth Bank).

- Look for the statement: “Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.”

- Check for shared licences, some brands operate under the same authorisation.

- Keep your savings within limits per authorised firm if you hold over £120,000 across the same Banking group.

OakNorth is listed on the FSCS register as an authorised UK bank, so your deposits are protected under the scheme.

Why FSCS protection matters

FSCS protection gives UK savers confidence that their money is safe, no matter what happens in the wider financial system.

Whether you’re:

- Building an emergency fund

- Saving for a home

- Planning for retirement

- Managing business reserves

The FSCS provides reassurance that your money is secure up to the protection limit.

OakNorth is authorised by the PRA and regulated by the FCA and PRA, meaning your eligible savings are protected by FSCS up to £120,000 per person.

Key takeaways

- FSCS covers up to £120,000 eligible savings per person (including joint accounts), per bank in the UK.

- Temporary high balances (e.g. from the sale of your primary residence) may be covered up to £1 million for six months.

- Always check your provider’s FCA/PRA authorisation.

- Consider splitting funds across institutions if you hold more than the FSCS limit.

- OakNorth Bank is FSCS-protected, PRA authorised and regulated by the PRA and FCA.

Final thoughts: saving securely with OakNorth

The Financial Services Compensation Scheme offers a vital layer of protection for UK savers, guaranteeing eligible deposits up to £120,000 per person, per authorised bank.

At OakNorth, you can save confidently knowing that all eligible deposits are covered by FSCS. We’re an authorised UK bank, regulated by the FCA and PRA, committed to keeping your money safe while it earns interest.

Explore our FSCS-protected savings accounts, including Fixed Term, Easy Access Tracker, Notice, Notice Base Rate Tracker and Cash ISA options, and enjoy the peace of mind that comes with saving securely.